Frequently Searched

Still stuck with slow old-school underwriting?

Here’s a TIP for you:

Transform your underwriting with

IDfy’s AI-powered Transaction Intelligent Platform (TIP)

-

Make smarter credit decisions with 400+ data points

-

Go Beyond bank statements - access data points from more than 12 databases

-

Identify the right persona for your product’s target group

IDfy’s solutions are trusted by Industry leaders

The checks and verifications built in IDfy help us identify and prevent fraud at source to a large extent.

With IDfy we went from onboarding 0% to 100% of our customers digitally for our small ticket loans business.

I wish IDfy all the best with their innovations so Banks like ours can embark on our digital journeys with them.

We are happy to partner with IDfy at a time when we are reimagining the future of the industry.

Underwriting just got smarter with

IDfy’s Transaction Intelligence Platform (TIP)

-

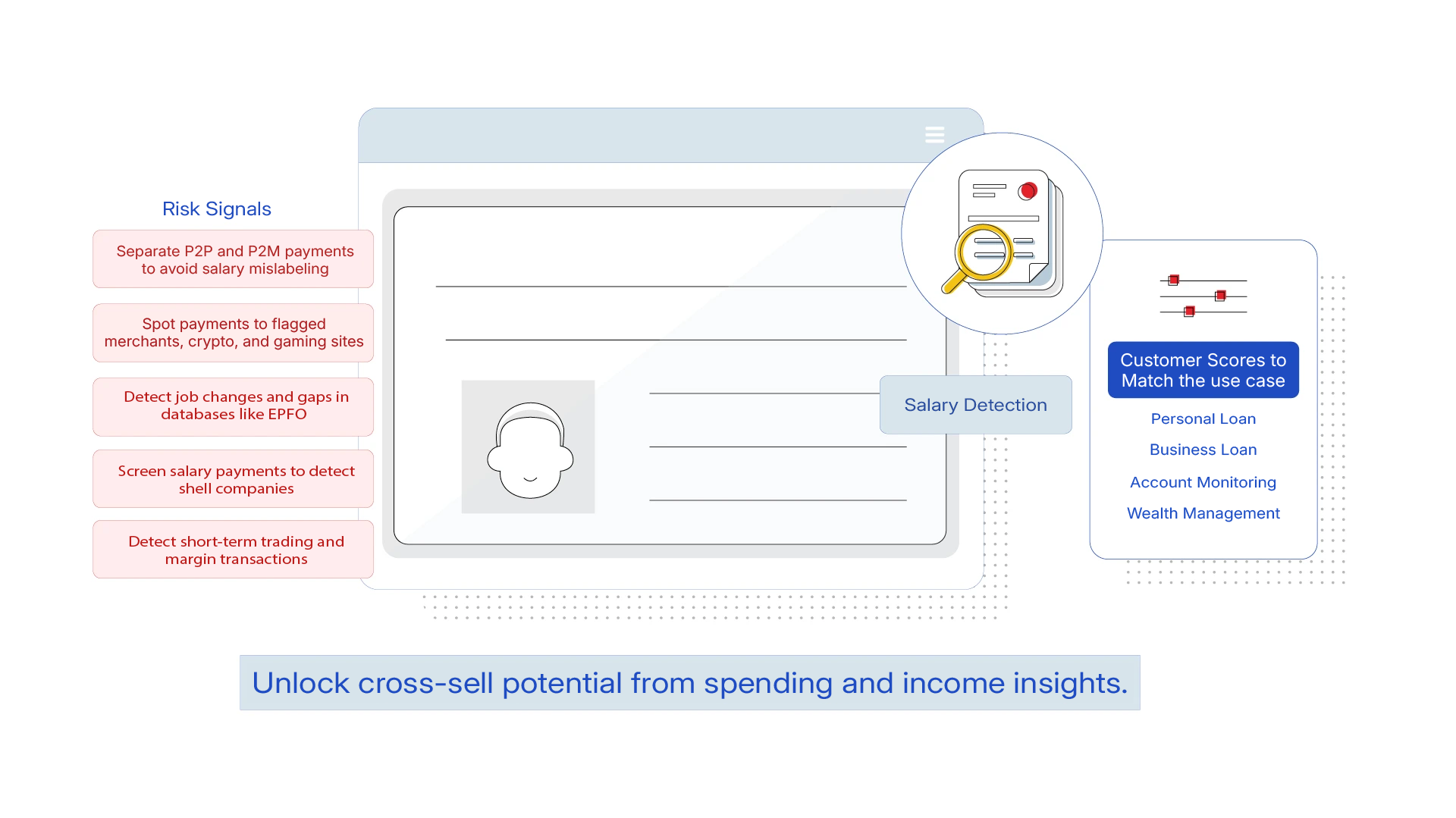

Pre-built library + Custom rules

IDfy’s T.I.P works with your existing journey (JSON) or our ready-to-use flows (Dashboard + Excel export).

-

Seamless Integration, no matter what you throw at it

Third-party platforms? Can do! In fact, we are pre-integrated with top LOS platforms.

-

Predict risk better than fortune tellers

Go beyond bureau scores with Our AI and LLM risk models go beyond bureau scores, categorizing each transaction type to create the right risk profile for each customer.

The result? Faster decisions, fraud-proof lending, and

most importantly, happy customers!

15%

Lower drop-off rates

45 %

More Risk & Cross-sell insights than existing tools

0%+

Fraud Detection accuracy

Video KYC

Video KYC