You and I aren’t strangers to cases of fraudulent bank employees robbing their customers. It’s a classic example of internal fraud where employees commit crimes against the same organisation that they’re working for.

Like in here:

- A reputed bank’s branch manager and another employee were arrested for committing criminal breach of trust by mismanaging Rs. 1 crore of a local woman

- A private bank employee was arrested for allegedly siphoning Rs. 3.2 crore from a Baguiati-based customer

And the list goes on…

Did you know that the industry has more than 70% of its employees involved in direct cash transactions? And the more the people involved, the more are the risks.

So far, they have used BGV to bounce off these risks. And now, they’re making it more stringent.

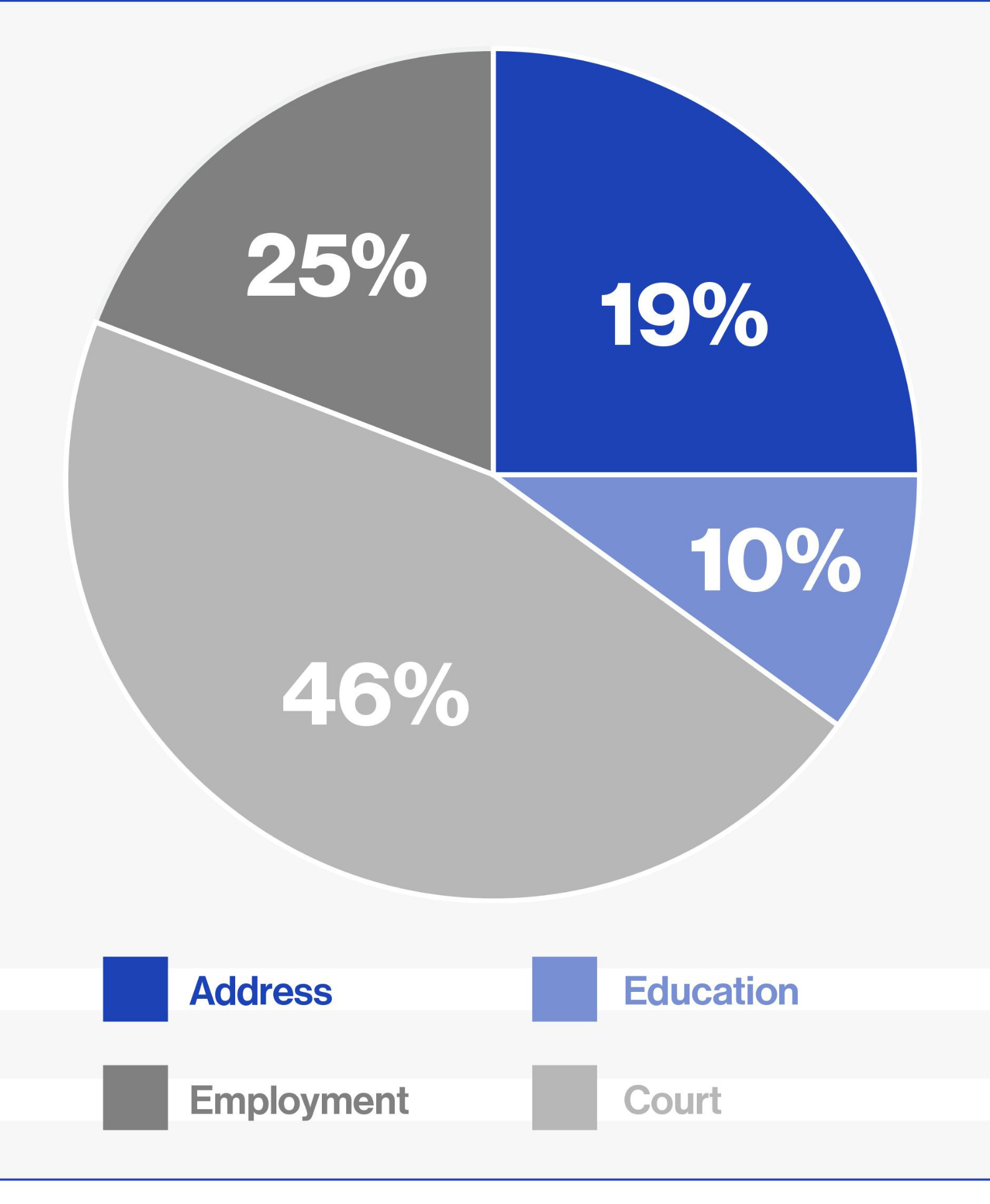

To help with the same, we analyzed our data to understand the employment fraud that the banks are most susceptible to.

At IDfy, we analyzed 3.5 Million BGV cases from 14 different industries. Here’s what we found about employment fraud in banking.

You can download our BGV insights report here.

The stats below talk of the top 3 employment fraud in banks HRs need to know while hiring.

Court record checks are mandatory. Here’s why

Criminals are to money like a moth to a flame. It’s hard to separate the two until an external force intervenes. Here, that force is a court record check.

Our data says that most of the red cases in the banking industry (46%) are due to adverse court record checks.

2.16% of the total BGV cases in the banking industry are marked red due to an adverse court record check (compared to the average industry rate of 0.22%).

Forged documents could slip right under your nose

Recently, our founder & CEO, Ashok Hariharan, was quoted in Economic Times:

Many ex-employees, in a hurry to take up new offers, submit forged documents to avoid any delay in their employment.

A whopping 29% of fraud related to forged documents happens in the banking industry.

A delayed FNF can lead to fraud

An incomplete FNF verification results in a red BGV case. This is motivation enough for an impatient candidate to arrange for fake documents.

Traditionally, Banks take 3 months to do a full-n-final (FNF) settlement with a departing employee. This is probably down to the sensitivity of the Banking business. There’s a greater emphasis on checking any possibility of fraud having been committed by the employee before leaving.

In the pursuit of getting quick employment, ex-employees of banks are often found forging FnF documents.

However, the new Bank that the person joins often gets an insufficiency status on the BGV report. Hence, banks end up with a higher percentage of failed BGV.

The situation doesn’t help anybody. For the sake of the industry and the people involved, this problem needs to be resolved. Possible solutions can include

- Use of advanced technology to complete F&F checks faster

- Coordination within the industry by using intermediate BGV clearances pending final reports.

Bonus: Check Criticality Matrix

IDfy’s Check Criticality Matrix plots different BGV checks on two parameters – the frequency of such fraud appearing in a particular industry and the impact such fraud can have on companies operating in that sector.

For more BGV insights of 13 other industries, download IDfy’s BGV Insights report 2021 now.

IND

IND ID

ID PH

PH