It had been raining for three straight days in Shillong, and Uday Imtisong was making his third trip between the bank and his house since that morning. Wading through knee-deep water, he wondered if his loan application would be approved anytime soon so that he could add a new wing to his popular gymnasium. He worried about his woefully inadequate credit history and his inability to provide a land bank as collateral for his loan – a common expectation from the lending officer at the bank.

As if that wasn’t enough, getting the bank to accept his proof of identity documents was another challenge. Not only did he have to get numerous photocopies of his original documents, but each copy had to be notarized by a public notary for the bank to consider it valid. If he were lucky, the bank would consider his application within the following month.

Getting credit, especially for first-time borrowers was a painful endeavor, perhaps not because of a lack of funds, but due to the administrative overhead around the application and the archaic verification process.

VKYC: The Secret Sauce in Instant Credit

Uday’s plight, shared by many similar individuals and MSMEs across India, changed with the arrival of Aadhaar-based identity verification systems. This solution landscape has since evolved so rapidly that Video-KYC (VKYC), where the person needn’t be physically present at the verification site, has become an industry standard.

Whether you’re a small business owner in Bidar or an individual trader in Amravati, as long as you have a functional mobile connection, you can apply for credit from a bank and receive a decision within minutes of submitting your application. Oh, and you no longer need to submit reams of photocopied and notarized documents for the bank to validate your application or establish your identity.

A Video KYC authentication uses advanced facial recognition and machine learning technologies to ensure that the lender can establish the borrower’s identity in a relatively frictionless manner. A camera phone on a barebones mobile data network is all that is needed for this to work.

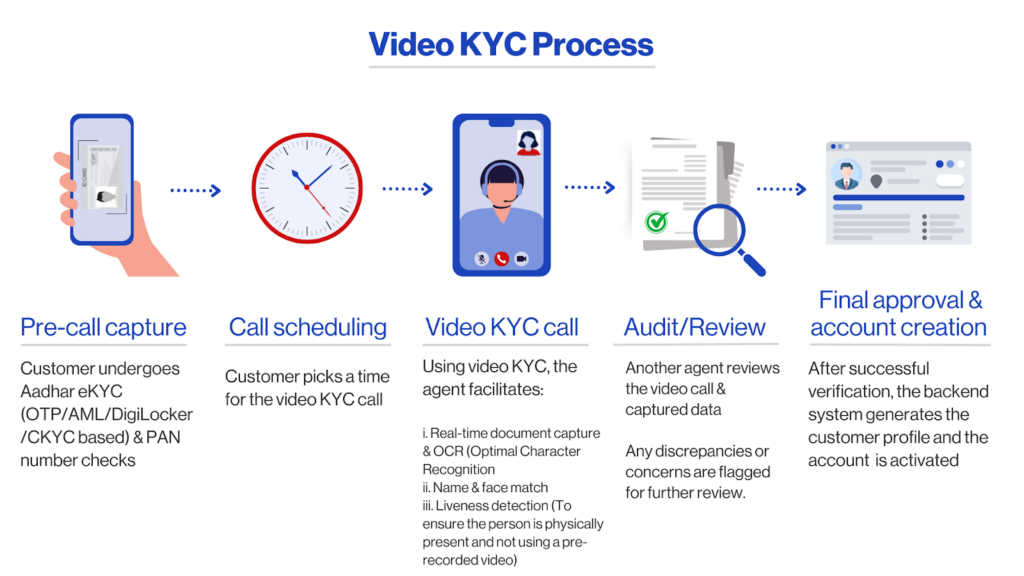

As illustrated above, the entire process is broken down into specific units of work that are done before, during, and after the call. With such a systematic process, real-time conditions on the borrower’s end, such as their language preference and the strength of their local mobile data network can be accounted for to ensure a good quality of interaction between the borrower and the lender’s agent. With lower drop-offs and a higher success rate of Video KYC, lenders are able to provide truly instantaneous credit.

Anatomy of a Paperless Onboarding: How Does Video KYC (VKYC) Work?

The way in which Video KYC works would appear to be a passage in a science function book, rather than a process that’s almost taken for granted today. The technology enabling this evolved so quickly that it changed the credit landscape almost overnight. Let’s take a look under the hood, and try to understand how this magic works.

It starts with a secure video connection that connects the borrower and a representative of the lending institution. The emphasis is on secure because the borrow shares sensitive identity related information, so the security of the connection cannot be compromised with. It’s tempting to trivialise this step, but picture a remote village where you struggle to receive a sufficiently strong data network, and the challenges begin to appear. To achieve pan-India coverage for such a Video KYC solution, companies such as IDfy develop very specialised solutions that enables live videos to render consistently without the risk of frequent drop-offs.

Next, the borrower uploads a government-issued identity, which could be an Aadhaar card, or a driver’s license. A piece of software then intelligently extracts all the text from the identification document, and structures this extracted text in a readable format. This step also isolates the borrower’s photo on the identification form and discerns all the relevant facial features from it.

Using the phone’s camera, the Video-KYC application then captures the borrower’s picture, ensuring it’s a live person by prompting the borrower to blink their eyes and only capturing a picture when the borrower’s liveness is established. This also prevents fraudsters from using an image or a still photo and gaming the verification process.

Sophisticated machine learning algorithms then perform what’s known as “face match”, where extracted features from the borrower’s identity document are matched against the corresponding features of the borrower’s image captured during the verification process. The application spits out a percentage parameter, which indicates the closeness of the two images as analyzed by the face-match algorithm. Only after a satisfactory threshold of facial features match, does the verification process gives a “green” result.

Advanced Video KYC solutions such as IDfy’s include advanced machine learning and artificial intelligence models that consider hundreds of borrower characteristics to flag suspicious or high-risk applications during the review process. Combining this information with the face-match results gives lenders the confidence that they are indeed dealing with a legitimate borrower.

And before we forget, the UIDAI has stringent guidelines on Aadhaar-based KYC guidelines that specify data retention protocols. A stat-of-the-art Video KYC solution ensures that lenders always stay compliant with these guidelines, which obviously change and evolve with time.

Seamless Credit: The Jet Fuel Powering the Nation’s MSME

This revolutionary technology has had a transformational impact on the lifeblood of India’s economy – the MSMEs or Micro, Small, and Medium Enterprises.

According to a May 2024 McKinsey report, MSMEs contribute to nearly 30% of the total business value generated by Indian corporates and employ nearly two-thirds of the country’s workforce. It’s ironic that these businesses historically struggled to obtain credit, and even when they did, it required long-drawn due diligence, frustrating paperwork, and provision of assets as collaterals, which not many owned. The situation was worse for first-time borrowers who didn’t have a credit history nor did they have a relationship with lenders.

Access to seamless credit is vital for the growth of any business, but with thin working capital and sub-optimal payment terms, it was even more so for MSMEs. Whether it’s expansion of capacity or investing in acquiring domestic and overseas customers, capital is key. Lenders too, for their part, were looking to deploy capital that would fetch them higher risk-adjusted yields, and MSMEs loans were seen as a relatively safe lending instrument.

Enter Video KYC, and the transformation of the MSME lending landscape. From an era of manual documentation and identity verification, MSMEs can borrow with minimal documentation and frictionless, instantaneous, and remote identity verification. The cardinal constraint that borrowers and lenders needed to be physically co-located no longer existed. With the geographical barrier removed, businesses in the most inaccessible parts of the country could now borrow and fuel their growth. This is how Video KYC transforms financial inclusion for remote areas in India.

First-time borrowers have more reasons to rejoice. No longer is a lack of credit history an impediment to getting credit at good terms. With increased digitization, lenders have the confidence to lend against receivables and other instruments that provide a guage to the borrower’s liquidity.

This has increased the velocity of credit application processing and disbursement, easing the much dreaded working capital problems for MSMEs, while giving comfort to lenders that they are lending to legitimate, verified entities.

With MSMEs getting timely access to credit, their expansion plans have yielded significant benefits, both in terms of topline revenue growth and better operational efficiencies due to timely investment in technology and capacity building. All this, eventually contributing to nation building and giving stronger credence to the “Make in India” movement.

Homes, Cars, and Dreams: Borrow Anywhere, Anytime

The impact on families and individuals has also been transformative and life-changing in many ways. Whether it’s a home loan for a family that moves into their first owned home or a young professional getting their first vehicle loan approved after moving to a new city from their hometown, the mechanism of owning an asset has changed for the better.

Small businesses, that used to previously struggle to borrow, are now able to grow their businesses thanks to the simplification in the entire process brought about by Video KYC technologies. The difference is not just in the democratization of credit through increased reach, but also in the speed of decision-making the technology has enabled, allowing businesses and consumers the comfort of a fair, expeditious process. With the Video KYC verification process now being done online, agents can the lender’s agents can communicate with borrowers in the relevant regional language, borrowers from different regions find it easier to relate to the process and be comfortable conducting sensitive, identity-related activity in familiar settings.

Crucially, with Video KYC resulting in the plummeting cost of identity verification, an increasingly larger number of regulated, local institutions can now deploy capital to provide credit to worthy borrowers. Lenders can realize better yields, while businesses get timely access to working capital – a truly win-win situation that is reaching every corner of the country.

IDfy has been at the forefront of providing solutions to banks and credit institutions, which has led to a dramatic rise in the conversion of loan applications. We do this by ensuring that both the borrower and the lending agent have the right experience before, during, and after the verification process—Want to learn how IDfy can help you convert more credit customers faster? Fill out the form for more information!

IND

IND ID

ID PH

PH