A few weeks ago, I logged on to a portal to check my credit rating. My heart pounded as I waited for it to fetch my score. I had this niggling feeling and I needed to check whether I had fallen victim to a ‘ghost loan’.

Well, my score was lower than I expected. But it didn’t take me long to realize that it was more due to my tardiness in paying bills than a fraudster taking a loan out on my name. I had mixed feelings about this.

Yes, Sunny Leone brought the topic of ‘ghost loans’ into the mainstream. So much so that even the RBI felt it may have to relook at the KYC norms.

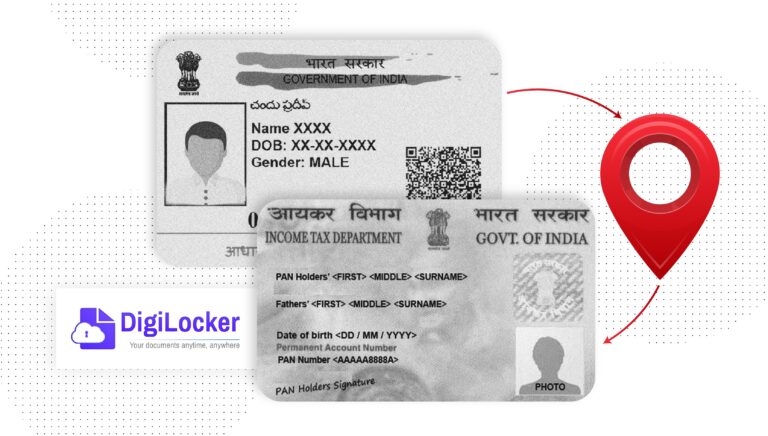

Stolen identities and tampered documents were at the heart of this problem. Digilocker sits perfectly to quash them. Not surprisingly, Digilocker’s adoption has been steadily growing in recent weeks.

The ‘ghost loan’ paranoia seems to be the impetus that’s opened the Digilocker floodgates. In reality, though, this has been in the making for a much longer time.

Here’s how it has unfolded.

RBI makes Digilocker compliant

I had written earlier about how offline verification of Aadhaar had become a pain for non-banking entities because of the frequent downtime of UIDAI’s servers. Until people realized XML-based verification was no longer the only way to verify an Aadhaar.

In a circular dated 12th May 2021, the RBI had made Digilocker-based Aadhaar verification a 100% compliant mode of verification. This was available for use by all regulated entities, not just banks.

Plus, it didn’t hurt that a Digilocker-based journey was much more reliable compared to offline Aadhaar. This meant higher uptime, consistent OTP delivery, and a superior UI.

This was the first checkpoint that gave Digilocker a fillip.

Great, so now Digilocker was available for use. But people had their doubts.

“My customers are from tier 3, tier 4 cities. They won’t have Digilocker accounts.”

“What if my customers haven’t uploaded their documents on the app?”

The beauty of Digilocker is in how it is designed.

Yes, an account is needed, but it can be created on the fly. For your customers, the journey remains the EXACT same whether they have an account or not. Enter your Aadhaar number, submit OTP, give consent to access documents, and move on.

Neither do they need to upload any documents, Digilocker is integrated with various India’s government databases and simply fetches documents directly from there whenever needed.

These include Aadhaar cards, PAN cards, and Driving licenses among others.

This realization helped further its adoption.

Digilocker’s benefits to the fore

We finally arrive at the last piece of this puzzle – FIs realizing how Digilocker in India is solving some persistent problems.

Since the documents are fetched directly from government sources, one can be assured that they aren’t tampered with.

Additionally, most of them are available as XML files. This means no OCR needs to be performed since all details are already present in a text format. Face match algorithms also run more efficiently as photos in these files are of high quality.

This ensures accurate verification results with almost no re-tries. This helps entities reduce drop-offs and onboard more customers.

All these advantages have led to the tipping point in Digilocker’s rapid adoption in India. If you haven’t incorporated this into your journey, I strongly recommend you try it out.

PAN is set to get the auto-update feature through Digilocker

UIDAI is making it easier for citizens to update their PII on government IDs. After making changes to their Aadhaar information, citizens can automatically update their address in their driving license via Digilocker.

PAN cards, the primary financial ID, are next to be auto-updated.

This step will make the verification process easier and more convenient. It will also lessen the number of offices a person needs to visit to update their address on government IDs. Read about it here.

________________________________________________________________________________

Digital governance and tech-enabled corporate regulation are the future

In the last few years, hackers have gotten more and more adept at using technology. FM Sitharaman advises financial sector regulators to invest in domain specialists who can secure their digital properties from fraudsters.

Digital governance and tech-based solutions are key to streamlining and optimizing business processes.

RBI allows the linking of UPI with credit cards

Credit cards can now be linked to the Unified Payments Interface (UPI) for smoother transactions. The RBI’s move will boost the popularity of our country’s most comprehensive payment method. While this will be enabled with RuPay first, other credit card companies will soon follow the suit.

________________________________________________________________________________

On a lighter note

We help companies like yours prevent fraud and engage with the genuine in a frictionless manner. Do get in touch with us at shivani@idfy.com if this is something we can help you with.

IND

IND ID

ID PH

PH