Private jets, lavish parties, and hobnobbing with political bigwigs might sound like a flogged horse of a movie script, but this is exactly what emerged when Neeraj Saluja, a director of SEL Textiles, was arrested in August 2020 for embezzling over Rs 1,500 crore. He, along with two other directors, were booked under section 420 (cheating) and several penal provisions.

Strangely, there was nothing subtle about the group’s modus operandi. As per media reports Between 2009 and 2013, they have cheated a consortium of 10 banks, siphoning the money off through bogus invoices, round-tripping, and related-party transactions.

This wasn’t a one-off heist either. Between 2009 and 2013, their company repeatedly borrowed significant sums of money without giving a whiff to their lenders of the massive theft that was underway. Only when the NPA hit the fan did they realize that they were funding the lavish life of a business tycoon.

Underwriting Hindsight is 20/20

Practitioners would claim that a bank’s lending decision is more art than science. But the looming question is – could this have been prevented?

The short answer is – yes. Banks consider a host of quantitative and qualitative data points while making lending decisions. But did you know that the legal history of an individual could impact their creditworthiness?

Credit history and bureau checks provide data about the ability and repayment behavior of borrowers. But how do you know about their “willingness” to repay your loans? This gets even trickier with NTC (new-to-credit) customers. Legal history can act as a great proxy in determining the intent of your borrowers.

Statistically, 84% of companies and 32% of individuals with a past criminal offense indulge in crime again (Based on a correlation study conducted by CrimeCheck on court records, available here). However, the type of offense they are involved in plays a key role in ascertaining their financial standing. For instance, an individual involved in an income tax violation case poses a much higher financial risk than somebody involved in a car accident case.

Nevertheless, no lender would bear the risk of financing a repeat offender, provided this information is available for the lender during underwriting.

Search the Dirt

If you’re a lender, you might wonder how much of this information is truly accessible to you? Would you get detailed information on all pending legal cases against your applicant? Is this information accurate? How reliable is it?

Well, there’s something called a “CrimeCheck Report” that does just that.

It is possible to scrounge through data across various institutions – from all levels of judiciary and tribunals to FIRs – and extract any relevant information about the individual in question.

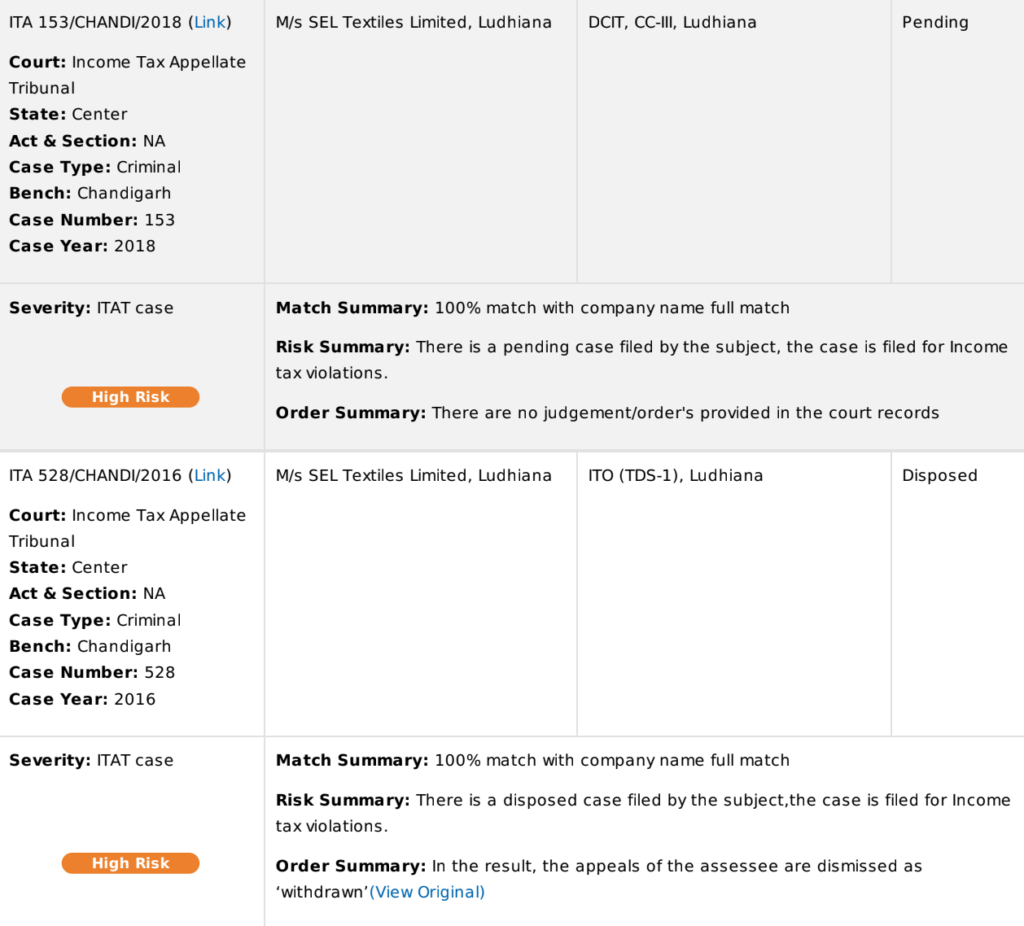

If SEL’s lenders had access to such a report, they would have known that SEL Textiles had 60 registered cases. Between 2015 to 2018, SEL was involved in multiple income tax violation cases in the ITAT (Income Tax Appellate Tribunal).

Due Diligence Swiss Knife

India and Singapore launching payments via UPI

UPI volume cap to be altered: NCPI and RBI

Web3 can transform financial data collection: FM Nirmala Sitharaman

On a lighter note…

IND

IND ID

ID PH

PH