Frequently Searched

Digital KYC Solutions

Enabling your customer’s in-person Verification in under 5 Minutes

Say goodbye to time-consuming in-person customer verifications!

IDfy’s Digital KYC solution helps you digitize your in-person customer verification process. A faster and more efficient journey of customer verification through field agents.

A packaged solution for instant KYC verification

IDfy’s Digital KYC is a packaged solution that has all APIs required for KYC, identification, and verification integrated into it. These include APIs for OCR data extraction, document verification from government databases, NameMatch, FaceMatch, Liveness, and Latitude-Longitude recorder.

With IDfy’s Digital KYC solution integrated into the official app, authorized field agents can not only capture customers’ documents on the app but also complete KYC verifications instantly. This allows you to onboard the customer immediately.

IDfy’s Digital KYC is fully compliant with RBI regulations.

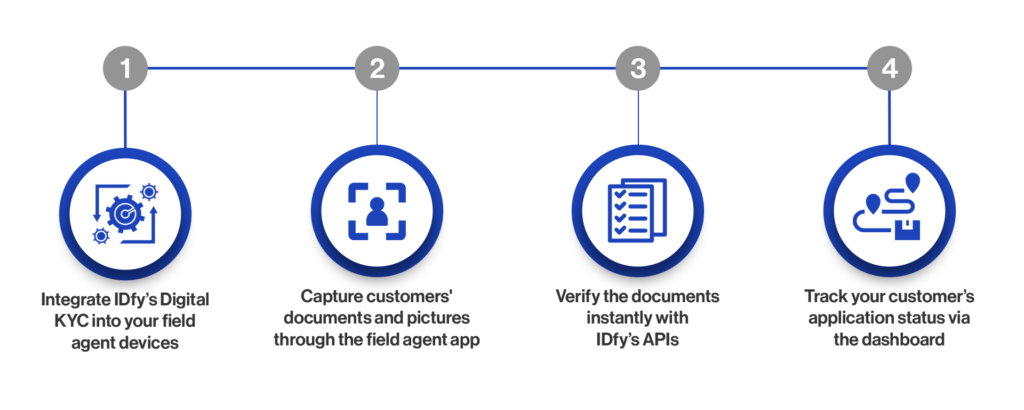

How Digital KYC works

- Instant onboarding and verification!

In the traditional KYC method, your on-field personnel goes to the customer’s location, collects documents, and sends them to the backend personnel for customer verification.

With IDfy’s Digital KYC solution, your field agent captures digital images of the customer’s documents on the mobile app, the documents are instantly verified from government databases, and the location coordinates are recorded.

The KYC status is immediately known. If there’s a mismatch, the customer can be requested to submit a different document. If not, the customer is ready to be onboarded.

- KYC is completed in 5 minutes

IDfy’s Digital KYC is designed for efficiency. It eliminates all manual processes involved in in-person verifications. This significantly reduces your time in processing an application.

Customers’ documents are verified on the go with IDfy’s Digital KYC solution installed on the feet-on-the-street devices.

What makes IDfy's Digital KYC solution unique?

One journey to perform all KYC checks

All essential customer verification fields are bundled in a single package, accessible on the agent’s device through a web view or SDK via sample code, for easy integration into your application.

Shorter KYC time means faster customer onboarding

With instant KYC approval, the customer can be onboarded immediately. Without back-and-forth on documents, customer drop-offs are prevented.

Compliance with regulatory requirements

IDfy’s Digital KYC solution is designed as per guidelines set by regulatory authorities like the RBI.

Our APIs are trusted in the industry

Video KYC

Video KYC