Frequently Searched

All you need to know about KYC (Know Your Customer) in India

Straight To Section

Know Your Customer, or KYC refers to the process of verifying a customer’s identity and other credentials before establishing a financial relationship with them.

If you’re reading this, chances are you’ve done your KYC at least once in your lifetime. Weirdly enough, it seems like it is one of those few things most of us share in common: a basic experience of the KYC process.

That being said, we’ve compiled this guide to help you get a more nuanced understanding of KYC in India – from history, definitions, and regulations to processes and everything in between – all in one place.

What is KYC and why is it important?

It is a standard due diligence process that banks and other financial institutions follow to establish a customer’s identity and the risks associated with them. It helps them ensure customers are who they claim to be.

The Reserve Bank of India (RBI) introduced the KYC guidelines back in 2002 in India. At a high level, it was meant to protect regulated entities from three things:

- Money laundering

- Terrorism funding

- Identity theft

Protection from financial fraud forms the basis for why KYC is important. Mandates to comply with KYC norms enforce these safety nets on financial institutions by law.

Consequently, non-compliance can incur heavy penalties from market regulators, as we have seen time and again in the past.

What are the different types of KYC?

- Physical KYC

It requires a customer to be physically present in the bank or a financial institution (FI) at the time of verification. The customer submits self-attested copies of proof of identity (POI) and proof of address (POA) for KYC.

- Aadhaar eKYC

It uses Aadhaar data stored with the Unique Identification Authority of India (UIDAI) to verify the identity of a customer. Aadhaar eKYC can be done using two ways – online and offline.

An online Aadhaar eKYC can be OTP-based or biometric (retina or fingerprint) based.

Offline eKYC can be done using an Aadhaar XML file or by scanning the QR code at the back of an Aadhaar card.

- Digital KYC

It’s a paperless mode of KYC. During digital KYC, the RBI requires an official representative (REP) to be physically present with the customer at the time of verification. The REP captures ‘live’ images of the customer and their officially valid documents. These images are further geotagged.

The data captured from the images is then verified against the data in the customer’s application.

- Video KYC

A video KYC process consists of two stages – the video call and the review. In the first stage, an official representative captures the customer’s POI and POA over a video call. The second stage involves a review of the video call by another representative.

The RBI deems video KYC to be a fully compliant mode of KYC, on par with physical KYC.

- cKYC

Central KYC, or cKYC, involves a FI using the customer’s KIN (KYC Identification Number) to access their documents from the central KYC registry (CKYCR).

Click here to know more about the benefits, challenges, and different KYC processes.

Learn More

What is eKYC? Meaning and types of eKYC

eKYC is simply a digital form of KYC. It is paperless and an effective alternative for lengthy in-person verification.

Anyone who has an Aadhaar card and a mobile number linked to it can undergo eKYC. For this reason, eKYC is also known as Aadhaar-based eKYC. It is performed in either of the two ways – online or offline.

- Online

Online eKYC can be OTP-based or biometric-based.

In OTP-based eKYC, the system generates and sends an OTP to the customer’s Aadhaar-linked mobile number. This OTP helps authenticate the customer’s Aadhaar number. Further, the KYC service provider receives the customer’s information from UIDAI’s database for verification.

Biometric verification uses a customer’s retina image or fingerprint for Aadhaar authentication. If a match is found, the KYC service provider receives the customer’s information from UIDAI’s database for verification.

- Offline

Offline eKYC can be done using an Aadhaar XML file or by scanning the QR code at the back of an Aadhaar card.

An Aadhaar XML is a password-protected file. A customer can download it from UIDAI’s portal after completing the Offline eKYC form. This file contains a customer’s basic demographics like name, birth date, gender, and postal address. Customers can share this file with FIs, along with a share code, for verification purposes.

The other way involves the QR code present on the back of an Aadhaar card. A KYC service provider scans this QR code to receive a customer’s information from the UIDAI’s Aadhaar database for verification.

What is cKYC? All you need to know about cKYC

Every time one requests new financial services, KYC must be performed. Even when that person has undergone KYC multiple times before. It’s repetitive. cKYC was introduced to change this.

With cKYC, a FI uses a customer’s KIN (KYC Identification Number) to access their documents from the cKYC registry. So, if the customer has undergone KYC before, a FI can verify them without requiring them to undergo KYC again.

The cKYC registry acts as a central database for the customer’s personal information. It reduces the burden of KYC document production and minimizes redundancy in KYC compliance.

How does the Video KYC process work?

Video KYC is an online KYC process where an official representative of a bank or FI verifies the customer over a video call. VKYC empowers the Regulated Entities (RE) to remotely verify customers without compromising on accuracy, safety, or compliance.

Further, vKYC ensures a frictionless customer onboarding experience and can be done in a short span of just a few minutes. It also takes care of data safety because of its end-to-end encryption. The only thing required apart from valid documents for a vKYC is a good internet connection.

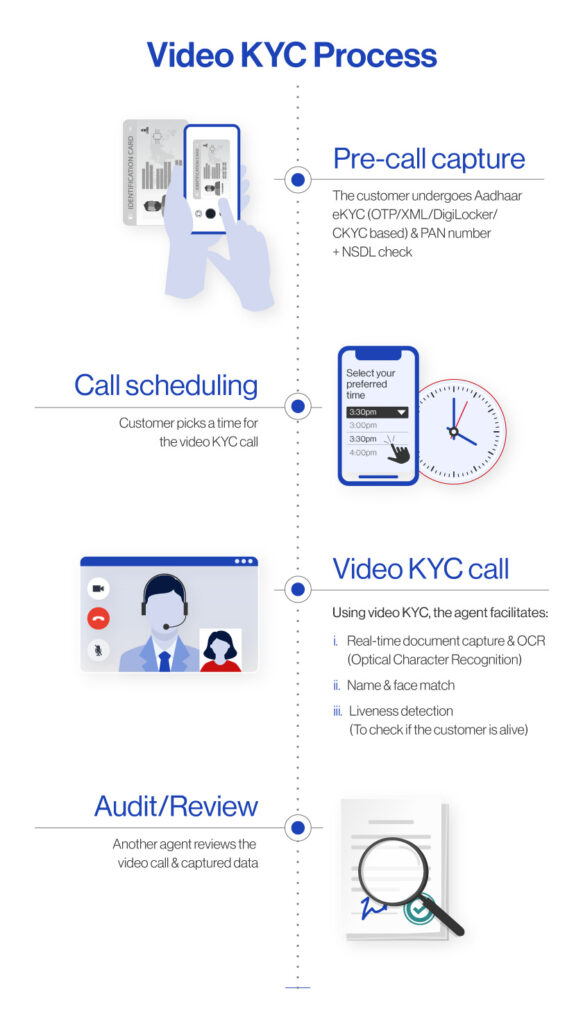

Here’s how vKYC works:

Before vKYC the customers undergo ‘Aadhaar eKYC’ and ‘PAN number and NSDL check’. Once they complete the verification, they can pick a suitable time for vKYC.

Then, using vKYC, the official representative facilitates real-time document capture, its OCR (Optical Character Recognition), the customer’s liveness detection (to check if the customer is live at the time of call), and a ‘face and name match’.

Post this, the video call and the data captured during the same are reviewed by another official representative. With this, the vKYC process is completed.

Here’s what IDfy’s video KYC process looks like:

What is reKYC? | reKYC process

A reKYC ensures that a customer’s documents, contact information, etc. collected at the time of account opening are up-to-date. As per RBI guidelines, it’s done at regular intervals depending on the risk category that the customer falls in. There are 3 risk categories viz, high-risk, medium-risk, and low-risk.

The factors that play a role in deciding a customer’s category are their identity, social and financial status, nature of their business activity, information about their business, and location among other things.

The high-risk category undergoes reKYC once every 2 years. While the medium and low-risk ones undergo KYC once every 8 and 10 years respectively.

In addition, customers who fall into the low-risk category don’t have to visit the bank for reKYC. They can get it done via Internet Banking, the bank’s mobile application, reKYC update link provided through the customer’s registered email ID, reKYC update link provided through the customer’s registered mobile number, SMS, or ATMs.

The reKYC process consists of 3 key steps:

- The customer fills a reKYC form

- The customer submits self-attested copies of acceptable identity and residential proof with the reKYC form

- The customer’s reKYC is processed in about 10 days following the first two steps

Learn More

What documents are required for KYC? | KYC norms in India

Documents like Aadhaar Card, Driving License, Passport, and Voter ID Card can be used as both, proof of address and proof of identity for KYC.

Other documents that can serve as proof of identity are:

- PAN Card

- Photo ID Card issued by the Central/State Government

- Photo ID Card issued by the Public Financial Institutions

- Scheduled Commercial Banks, or Public Sector Undertakings

- Photo ID cards issued by professional bodies such as ICAI, ICSI, Bar Council, etc.

Further, for proof of address, one can use these documents:

- Registered Agreement for Lease or Sale of Residence

- Utility bills not older than three months

- Bank account statement not older than 3 months

- Self-declaration validating the address offered by a High Court or Supreme Court judge

- Address proof issued by bank managers of Multinational Foreign Banks, Scheduled Commercial Banks, or Scheduled Co-Operative Banks

- Address proof issued by a central/state government department, or any of the statutory or regulatory bodies

- ID card with address issued to members by professional bodies such as ICAI, ICSI, Bar Council, etc.

- Land or municipal tax receipt

- Monthly pension payment records issued by ministries or public sector companies that have the address mentioned.

RBI has established specific norms and guidelines for KYC.

Learn More

What is the difference between KYC and AML?

Prevention of financial fraud has given birth to many compliance rules, guidelines, and processes. What makes them difficult to understand is the variety of terminologies that come along. One such case is KYC and AML. Both might be used interchangeably, but their concepts are different.

‘Know your Customer’ or KYC is a part of the wide ‘Anti-Money Laundering’ or AML umbrella.

As AML aims to reduce money laundering and terrorism funding, it ensures customer verification for financial transactions using KYC.

Apart from KYC, AML also includes other practices. These are monitoring financial exchanges, reporting suspicious activities to regulators, ongoing risk evaluation, methodical internal audits, and AML compliance training for employees.

KYC and AML also differ in their process, scope, and purpose.

What is money laundering & what are AML guidelines in India?

In layman’s language, money laundering is turning ‘black’ money into ‘white’. Fraudsters use this way to make the ‘dirty money’ look like it came from a legitimate source. In the case of REs, if they are found knowingly or unknowingly facilitating such transactions, they may be treated as an accomplice. AML or Anti-Money Laundering ensures the prevention of such risks.

According to RBI, REs must screen individuals and entities against certain global and national lists, such as:

- Key UN sanctions lists (ISIL, Al Qaeda, and the 1988 Sanctions List)

- Designated terrorist list as circulated by the Ministry of Home Affairs (MHA)

- Foreign Politically Exposed Person (PEP) list

The above are only some of the numerous checks that the RBI mandates. The RBI has an exhaustive list as per various circulars and master directives issued.

Video KYC

Video KYC