Frequently Searched

Know Your PAN

Straight To Section

What is PAN verification?

PAN (Permanent Account Number) verification refers to the process of confirming the authenticity and validity of a PAN card issued by the Indian Income Tax Department. PAN is a unique alphanumeric code assigned to individuals, companies, and entities in India for tax-related purposes. Verifying a PAN is essential for various financial and legal transactions, as it helps ensure that the PAN provided is legitimate and matches the details of the person or entity claiming it.

Know Your PAN (KYP) is a set of digital, and sometimes physical processes that are employed to verify PAN numbers.

What are the different methods of PAN verification?

Of late, multiple Know Your PAN utilities have emerged. They are listed below:

Online PAN Verification

Identity verification authenticates the identity of an individual. It is defined as a unique set of traits and characteristics that pertain to the individual. Considering remote working and a digital work environment, identifying theft is a more common phenomenon than we think.

- Income Tax Department’s Portal: The official website of the Income Tax Department of India provides an online facility for PAN verification. You can enter the PAN number to verify its validity.

- NSDL PAN Verification: The National Securities Depository Limited (NSDL) also offers an online PAN verification service. You can visit the NSDL website and use their PAN verification tool.

- UTIITSL PAN Verification: But wait, what is UTIITSL?

The UTI Infrastructure Technology and Services Limited (UTIITSL) is a government-owned company that provides technology and outsourcing services in the financial and information technology domains. It was established in 1993 and is headquartered in Mumbai. It serves various sectors, including finance, taxation, and e-governance, by offering technology solutions and services.

One of its significant functions is providing PAN (Permanent Account Number) card-related services on behalf of the Income Tax Department of India. This includes processing PAN card applications, issuing PAN cards, and updating PAN card information. The UTIITSL portal can be used for PAN verification.

While most of the PAN verification is done via NSDL, UTIITSL is also fast gaining popularity.

The details that are generally needed are as follows:

Name and Date of Birth Verification:

Some online platforms and government agencies allow you to verify a PAN by providing the PAN holder’s name and date of birth. This method cross-references the information with the Income Tax Department’s database.

Name and Father's Name Verification:

This method involves verifying a PAN by providing the PAN holder’s name and their father’s name.

Physical PAN Card Verification:

In some cases, for more stringent verification, individuals or organizations may request a physical copy of the PAN card for verification. This can be done by providing a photocopy or scanned copy of the PAN card.

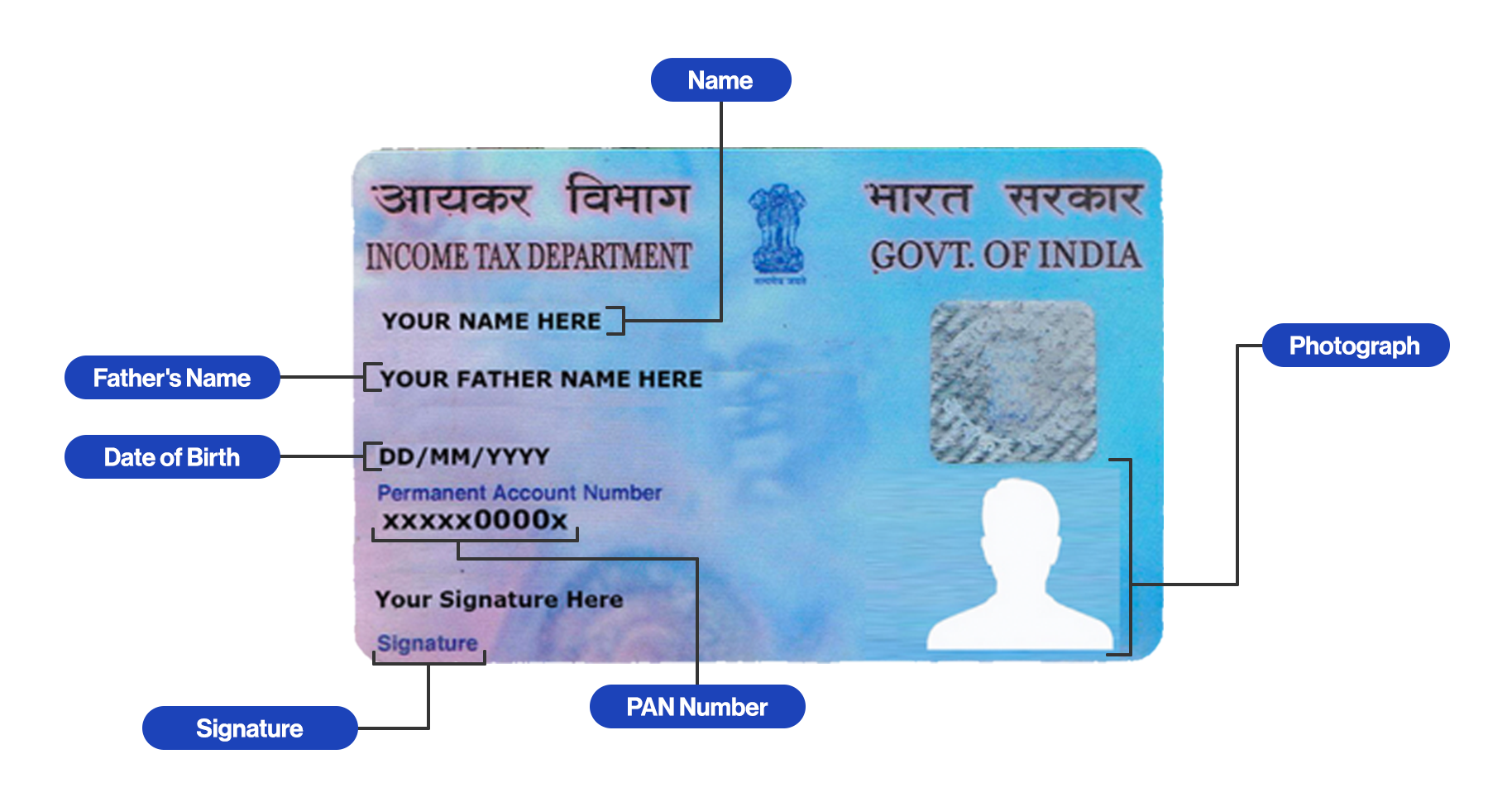

Elements verified in a PAN

In PAN (Permanent Account Number) verification, several elements and details are typically verified to ensure the accuracy and legitimacy of the PAN card and the associated individual or entity. These elements include:

PAN Number

The primary element verified is the PAN number itself. This is the unique alphanumeric code assigned to the PAN cardholder. The verification process checks whether the provided PAN number is valid and matches the records in the Income Tax Department’s database.

Name

The name of the PAN cardholder is an essential element verified during the process. It ensures that the name provided matches the name on record with the Income Tax Department. Discrepancies or misspellings can raise concerns during verification.

Date of Birth

Verification may involve cross-referencing the date of birth provided with the Income Tax Department’s records to confirm that it matches the PAN cardholder’s date of birth.

Father's Name

For individuals, the father’s name is often verified as an additional identifying element. It helps confirm the identity of the PAN cardholder, especially when there are multiple individuals with similar names.

Photograph

The photograph on the PAN card is visually verified to ensure that it matches the individual’s appearance. This is often done during physical verification processes.

Status of the PAN Card

PAN verification may also check the status of the PAN card, including whether it is active, inactive, or has any associated discrepancies.

Signature

In some cases, the signature on the PAN card may be verified to ensure its authenticity. This is particularly relevant in situations where a physical copy of the PAN card is presented.

Aadhaar Linkage

In certain instances, PAN verification may also involve checking whether the PAN card is linked to the individual’s Aadhaar details. This linkage can provide an additional layer of verification.

Know Your PAN – The specific elements verified during PAN verification may vary depending on the verification method and the requirements of the verifying authority. The primary goal is to ensure that the PAN card is valid, matches the individual or entity’s identity, and is not being used for fraudulent purposes.

What are the biggest frauds possible in PAN verification?

There are several potential frauds or scams that individuals and organizations should be aware of when conducting PAN verification:

Fake or Tampered PAN Cards

Fraudsters may create counterfeit PAN cards with fictitious details or may alter or tamper with a genuine PAN card to change details or create a new identity.These fake PAN cards can be used for various illegal activities, including tax evasion and identity theft.

Mismatched Details

Inaccurate or mismatched information, such as misspelled names or incorrect dates of birth, can be used to create discrepancies during PAN verification, potentially allowing individuals to open fraudulent accounts or engage in other illicit activities.

Identity theft

Criminals may use stolen personal information, such as name and date of birth, to obtain a PAN card in someone else's name. This can lead to financial fraud and misuse of the victim's identity.

Duplicate PANs

Some individuals may possess multiple PAN cards with different details. This can be done to conceal income or engage in fraudulent financial transactions.

Know Your PAN – To prevent these frauds and ensure the integrity of PAN verification, individuals and organizations should:

- Verify PAN cards through official channels provided by the Income Tax Department, NSDL, or UTIITSL.

- Cross-check PAN details with other identity documents and information to identify discrepancies.

- Be cautious when verifying PAN for high-value transactions or sensitive activities.

- Report any suspicious or fraudulent PAN cards or activities to the authorities.

- It’s essential to exercise due diligence when dealing with PAN verification and to verify the authenticity of PAN cards and associated details to protect against fraud and financial misconduct.

What are the possible areas/sectors where PAN verification is a must?

PAN (Permanent Account Number) verification is required in various financial and legal contexts in India. It serves as a crucial tool for verifying the identity and financial transactions of individuals and entities.

There are three specific areas in which PAN verification is a must:

Applying for financial instruments

When an individual wants to avail of a particular financial product/service, PAN verification is one of the most important and foremost steps. Some of such instances are as follows:

- Bank Account opening: When opening a new bank account, individuals and entities are required to provide their PAN details for KYC (Know Your Customer) purposes. Banks verify PAN information to comply with anti-money laundering regulations and income tax reporting requirements.

- Demat Account Opening: Individuals who wish to open a Demat (Dematerialized) account for trading and investing in securities and shares must provide their PAN details for verification.

- Loan Applications: Banks and financial institutions verify PAN details when processing loan applications to assess an applicant’s financial history and creditworthiness.

- Credit Card Applications: Credit card issuers may verify PAN details as part of the application process to assess the applicant’s creditworthiness and ensure accurate reporting to the credit bureaus.

Completing financial transactions

Some of the most common financial transactions are deposits, payments, and investments. PAN verification is needed for some of these transactions – e.g. if the deposit amount is more than Rs. 50,000. Some of the common instances where PAN details are needed for transaction completion are:

- Stock Market Transactions: PAN verification is essential for stock market-related transactions, such as buying and selling shares, mutual funds, and other securities. It helps track capital gains and taxes on investments.

- Property Buy/Sell: PAN details of both the buyer and seller are often required for property transactions to track capital gains and ensure compliance with income tax regulations.

- Vehicle Buy/Sell: For high-value vehicle purchases, such as cars and bikes, PAN verification may be necessary to comply with reporting requirements.

- Fixed Deposits and Investments: Financial institutions require PAN verification for fixed deposits and various investment instruments to monitor interest income and comply with tax regulations.

- Foreign Exchange Transactions: PAN verification is mandatory for foreign exchange transactions, including travel abroad, to comply with Reserve Bank of India (RBI) guidelines.

- Insurance Premiums: PAN details may be required for paying insurance premiums, especially for high-value insurance policies, to comply with tax regulations.

Employee/Partner lifecycle management

The third largest area of Know Your PAN verification is employee/partner lifecycle management, from onboarding till the employee/partner is associated with the employer/business:

- Merchant Onboarding: PAN + GST are clubbed together and verified to understand if the business has been logging the right revenue

- White/Blue/Grey collar employee onboarding: PAN verification is an important part of employee background verification along with court checks and similar checks

- Income Tax Filing: PAN verification is mandatory for individuals and entities when filing income tax returns. It helps the government track taxable transactions and ensures that the correct taxpayer is reporting income and paying taxes.

- Salary and Professional Fees: Employers and clients often require PAN details for employees and contractors to comply with tax deduction at source (TDS) regulations when disbursing salary or professional fees.

Other than the above instances, PAN verification is also often a requirement when participating in government tenders or entering into contracts with government agencies.

What are the solutions available in the industry for PAN verification

PAN OCR

Extracts data from PAN Cards instantly and accurately. IDfy’s PAN Card OCR API extracts data from an image of a PAN card. It accurately auto-fills this data in the right fields for a quicker & errorless form-filling experience.

PAN Verification

Instant PAN Card Verification using government database check. IDfy’s PAN Card Verification API instantly verifies details of a PAN Card by confirming them from the Government database. This makes your onboarding process faster, safer and smarter. With IDfy’s PAN verification, you can be confident that the individuals or merchants you onboard hold a valid PAN card and have provided you with the right identity proof. Couple it with IDfy’s PAN OCR API to make your identity verification and onboarding process seamless and instant.

PAN Tampering

Eliminate fraudulent onboarding at source by ensuring that the PAN image provided to you is not a tampered card. IDfy’s PAN tampering API allows you to be confident that the PAN card supplied to you hasn’t been built using a fake PAN generator app, doesn’t have a passport photo pasted on it, and has all the expected color schemes that a standard PAN is expected to have.

PAN Aadhaar Linkage

Reduce the risk of fraud on your platform by onboarding only those individuals whose PAN is linked with their Aadhaar, in accordance with the laws of India. Reduce manual efforts by calling a single API which tells you if an individual’s PAN Aadhaar link exists or not.

PAN GST Linkage

Having a GST registration / number becomes mandatory once you exceed a certain revenue for your business. These GST numbers for a business are registered using a business’ / owners PAN card. But ensuring a certain PAN is linked to a specific GST number becomes an important step in ensuring a non-fraudulent merchant / user journey. IDfy’s PAN and GST linkage API allows you to find, verify and fetch the details of all GST numbers linked to a specific PAN number.

What is the basis for tagging PAN as invalid?

A PAN (Permanent Account Number) can be tagged as invalid or deactivated for various reasons by the Income Tax Department in India. Here are some common bases for tagging PAN as invalid:

- Multiple PANs Issued: If an individual or entity is found to possess multiple PANs, all but one PAN may be tagged as invalid. Possessing more than one PAN is a violation of tax regulations.

- Incorrect Information: If the details provided in the PAN application are inaccurate, incomplete, or mismatched with government records, the PAN may be considered invalid.

- Non-Filing of Income Tax Returns: Individuals who are issued a PAN are generally required to file income tax returns, even if they have no taxable income. Failure to file returns for an extended period can lead to PAN deactivation.

- Non-Compliance with Income Tax Department Notices: If an individual or entity fails to respond to notices or inquiries from the Income Tax Department or does not comply with tax-related requirements, their PAN may be tagged as invalid.

- Duplicate PANs Detected: If the Income Tax Department identifies duplicate PANs issued to the same entity, one of them may be deactivated.

- Misuse or Fraudulent Activities: PANs associated with fraudulent activities, tax evasion, or other illegal practices may be marked as invalid.

- Inactivity: PANs that have not been used for a long time and have no reported financial activity may be deactivated.

- Death of the PAN Holder: In the case of an individual’s death, their PAN may be deactivated after proper documentation and verification.

- Suspicious Transactions: If a PAN is linked to suspicious financial transactions, it may be investigated, and if wrongdoing is found, the PAN could be invalidated.

- Non-Verification of PAN: Individuals or entities may be required to verify their PAN details periodically. Failure to complete the verification process can lead to deactivation.

Know Your PAN – It’s important to note that the process of tagging a PAN as invalid or deactivating it is typically carried out by the Income Tax Department after due diligence and verification. PAN holders are usually given an opportunity to rectify any discrepancies or issues before their PAN is invalidated.

Video KYC

Video KYC